I'm off to Providence tomorrow to represent the Tax Foundation at Netroots Nation, accompanied by media manager Richard Morrison. It'll be an interesting experience - we're a non-partisan organization, but generally perceived to be libertarian/center-right. Being generally center-left as I am on most issues my job is to sell our research to the more progressive/liberal types that will be at Netroots Nation. We do a lot of good work that people all over the ideological spectrum can get behind. One of the important points I try to make when people express surprise that a liberal like me would work for a libertarian think tank is that the methods of taxation are an independent policy question from the levels of taxation. It's generally possible for a tax system to raise lots of revenue while minimizing the economic damage it causes, just as it's also possible for a tax system to raise almost no revenue at all despite wreaking economic havoc. There are good and bad ways to raise taxes, and good and bad ways to cut them.

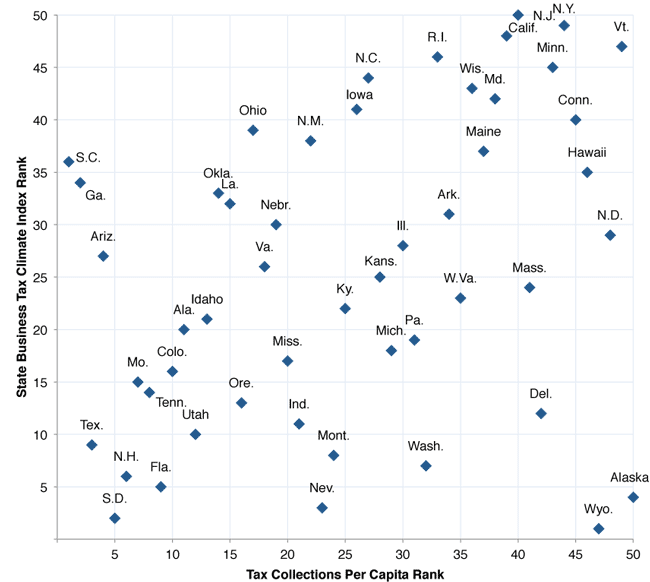

On this point, I'll point you to two Tax Foundation publications - No. 1 is our State Business Tax Climate Index, and No. 2 is some simple data we've republished from Census - State Tax Collections Per Capita. The Business Tax Climate Index is an attempt to measure the quality of a state's tax system (based on some admittedly subjective value judgments) while the dataset is simple the raw amount that each state collects per person, and thus a measure of the level of taxation in the state. Here's what happens when you graph each state's index rank vs. it's collection's rank:

(One flaw here is that the Index is for 2012 and the collections data is from 2010, but you get the idea.) The chart is pretty scattershot, and the correlation is pretty weak. Delaware is a good example of a state that manages to collect a fair amount of revenue in a nevertheless non-economically destructive way (Alaska and Wyoming are special cases because of revenue from oil and energy taxes, which are to some extent passed on to out-of-staters.) Ohio, South Carolina, and Georgia are the opposite - they don't collect so much revenue but still have fairly harmful tax systems. The point here is that a liberal like me can still argue for sound, principled, non-destructive tax policy while still believing (somewhat) in the power of government to improve people's lives.