Kerbal Space Program is a fantastic video game. It combines a reasonably accurate simulation of orbital mechanics and Newtonian physics with a spaceship-building interface in which the player puts together a spaceship from a large number of available parts (such as fuel tanks, engines, stage separators, etc.) The game takes place in the fictional solar system of Kerbol, and not our own Solar System - and this is, I think, primarily a game-balancing mechanic that makes most tasks a bit easier for non-rocket scientists. The planets are significantly more compact and dense than in the real Solar System, and this makes it easier to get into orbit.

Your astronauts are little green aliens called "Kerbals." They come from the planet Kerbin (the Earth analogue of the game) and they're hardy little creatures - for one thing, they can't die unless their spaceship crashes. The game doesn't (yet) bother with things like life support, food, or other consumables, so it's possible for your Kerbals to survive indefinitely in deep space or on the surface of another planet.

Much of the appeal of this game lies in the creative freedom it offers the player - there's a huge variety in the types of spaceships that can be built, and gameplay itself is relatively open-ended in that the game doesn't tell you where to go or what missions to do; you set your own goals. It's relatively easy to get into orbit, a bit harder to orbit and then land on the moon, relatively difficult to land on the Mars-analogue planet, and so on.

The most effective way to communicate the appeal of this game is to tell the story of what (to me, at least) was a fairly difficult mission - a successful return trip from Laythe (one of the moons of Jool, the Jupiter analogue.) Laythe has no real-world equivalent - it's sort of like Saturn's moon Titan in that it has an atmosphere, but it's much more Earth-like, with blue skies, water oceans, but still too cold to support life. My first attempt at getting here ended in disaster - I realized too late (after saving my game) that my lander didn't have enough fuel to make it back into orbit - my star Kerbalnaut, Jebediah Kerman, was stranded, with no way to get back to Kerbin. (Some people, who play this game much more seriously than I do, go through the trouble of calculating the total delta-V of their spaceships from the mass and engine thrust; I don't yet have the energy for that and tend to take a more trial-and-error approach.)

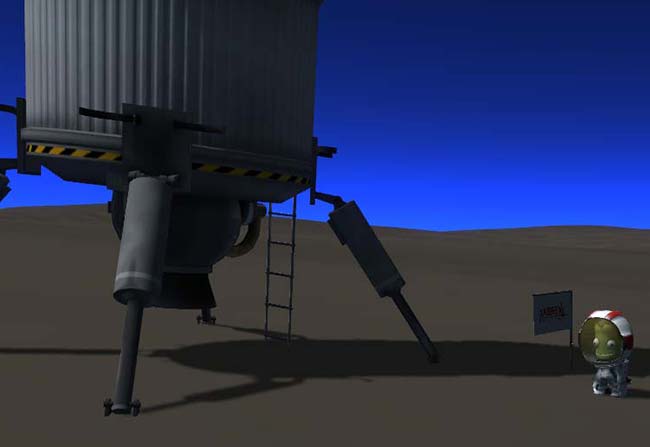

Here's Jeb standing by the lander he came down on.

He's not very happy, because he knows he's going to be here for a very long time.

In order to rescue him, I needed to send him a significantly larger ship. The challenge, of course, is that the larger the lander, the larger the ship to get it there in the first place, which means you need more fuel to get into orbit from Kerbin, which adds weight, so you need bigger engines, and so on and son on - even a relatively small change to a late-stage piece of the ship can dramatically increase the amount of fuel needed in the earlier stages to get the thing off the ground. I knew I was going to need to build a very large ship if this was going to work.

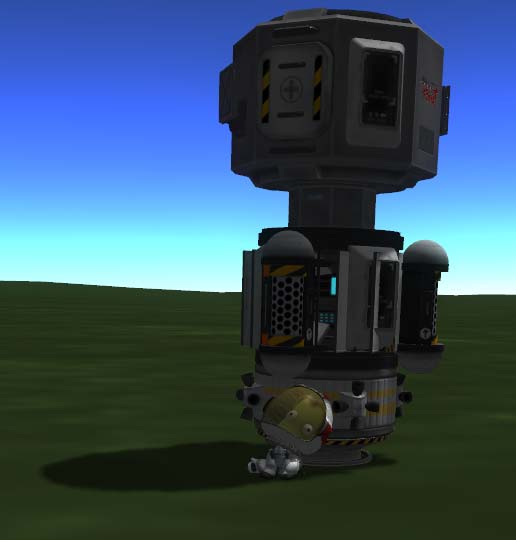

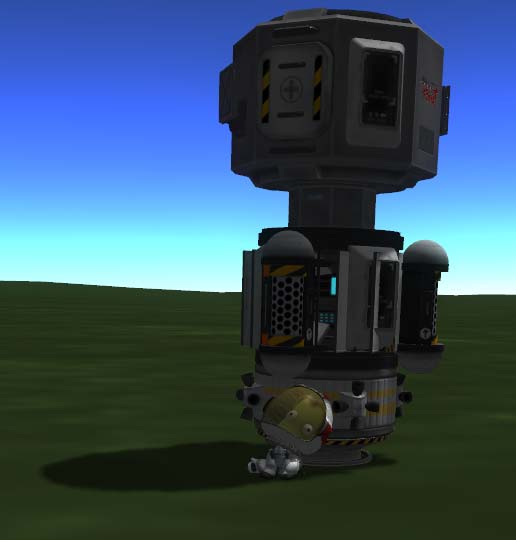

Meet the Laythe Express (version 2.0):

It's huge and obviously completely unaerodynamic, but that tends to not be much of a problem for the relatively simple atmospheric flight model in this game. It also has a probe core attached, so it can be flown remotely - no astronaut required. (This is good because the lander only has space for one, and Jeb needs that spot to come back.) Craft file here if you have the game and want to give it a shot.

Getting into Orbit

If your ship is up to the task, getting into orbit is relatively simple:

Leaving Kerbin

The next stage of the journey is to leave Kerbin's sphere of influence and get into a direct orbit around the Sun. I used a slingshot around the Mun (Kerbin's moon) to save fuel.

The Journey to Jool

Interplanetary transfer is done through a Hohmann transfer orbit. KSP makes it relatively easy to find a transfer using maneuver nodes.

Getting into Orbit Around Laythe

Three years later, I entered Jool's sphere of influence. The earlier approximation that said I was on course for Laythe didn't hold up, so after making some small course corrections, I set up a course to skim across the upper part of Laythe's atmosphere. This maneuver (aerobraking) saves a ton of fuel, but it's hard to get exactly right - too low and you'll end up on a suborbital trajectory and need to land; too high and you'll speed past without getting captured into orbit.

Landing on Laythe

Landing close enough for a rescue was challenging. It's hard to target the landing spot precisely - the atmospheric braking and entry makes it hard to calculate exactly where you'll end up. Jeb's landing site was on a relatively small island, so just a little bit off and I'd splash down into the ocean; furthermore, the island was very hilly - most of it too steep for the lander to stand up. Fortunately, I could save and reload as necessary, and after four or five tries managed to land around 18km from Jeb.

Jeb's Journey to the Lander

Despite my best efforts, the closest I managed to get to Jeb's base was still around 20km away. In theory, I could have just had Jeb walk across the island - but that would have taken a few hours of just holding down the "walk forward" button, which isn't much fun - there's no way to speed up time during EVAs.

Fortunately, the lander Jeb came down on was still functional. It may not have had enough fuel to get into orbit, but it sure had enough to fly halfway across a small island.

Back to the Mothership

The next step was to take off and rendezvous with the interplanetary stage. This requires matching its orbit and velocity, which is somewhat challenging.

Leaving the Jool System

Just as with Kerbin, it was possible to save on fuel by flinging my ship around another one of Jool's moons.

Returning to Kerbin

To get back to Kerbin, I used another Hohmann transfer orbit - basically the reverse of how I got out to Jool.

Re-entry and Landing

After another three in-game years, the rescue mission was almost over. Once I got near Kerbin, I made a few minor course corrections to set up a smooth re-entry, filled the lander back up with fuel, sent the mothership to crash down near Kerbin's north pole, and landed Jeb on an equatorial plain.

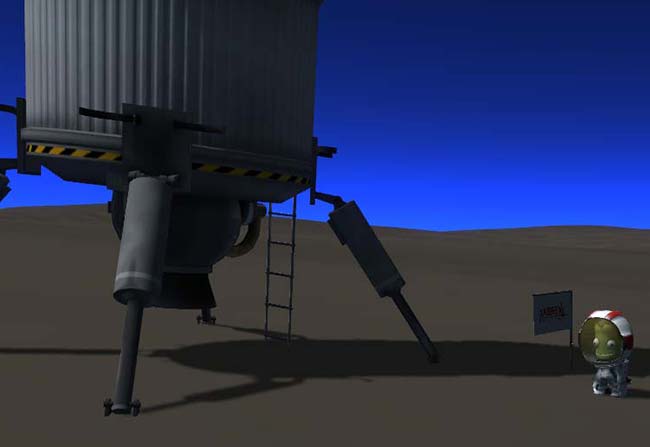

Jeb was quite happy to be home. Here he is, safe and sound, waiting by his ship for recovery and debriefing.

I think he deserves a good long rest, so I'll send another Kerbal on my next mission. Not sure where it will be - I want to try landing on Eve (the Venus equivalent planet) - it's easy to get to but very difficult to take off from due to its high gravity and think atmosphere, so I'll need a very large lander.

Anyway, the point is that this game is great and you should buy it.